Downside Protection for Everyone

Experience the benefits of Tactical Management

Life's too short to worry about market setbacks.

Global View Capital Management provides a variety of innovative solutions that aim to deliver protection in severe market declines yet still participate in up markets.

By following a specific set of risk targets for each strategy and portfolio, that is not benchmark-centric, the investment management programs are unconstrained. The old rules of static asset allocation and passive investment to manage risk and return no longer work. To adapt to a world whose markets have become globalized, investment management needs to adapt to multi-dimensional forces that are more complex than ever.

GVCM believes that risk and return is better defined by the client reaching their goals and minimizing the impact of black swan events that have been ruinous for portfolios, wiping out trillions in global market value.

Understanding the Law of Losses

The bigger the loss, the greater the rate of return needed to get back to even.

For example, a 50% loss will require a 100% gain in order to get your account back to even.

A Look at Maximum Loss During Risk Events

With increased globalization, markets are more interconnected than ever and when unpredictable events [Black Swans] occur they can ravage the financial markets and client portfolios.

Black Swan: a highly improbable event with three principle characteristics: it is unpredictable; it carries a massive impact; and after the fact, we attempt to concoct an explanation that makes it appear less random and more predictable than it was.

– Nassim Nicholas Taleb, New York Times best-selling author

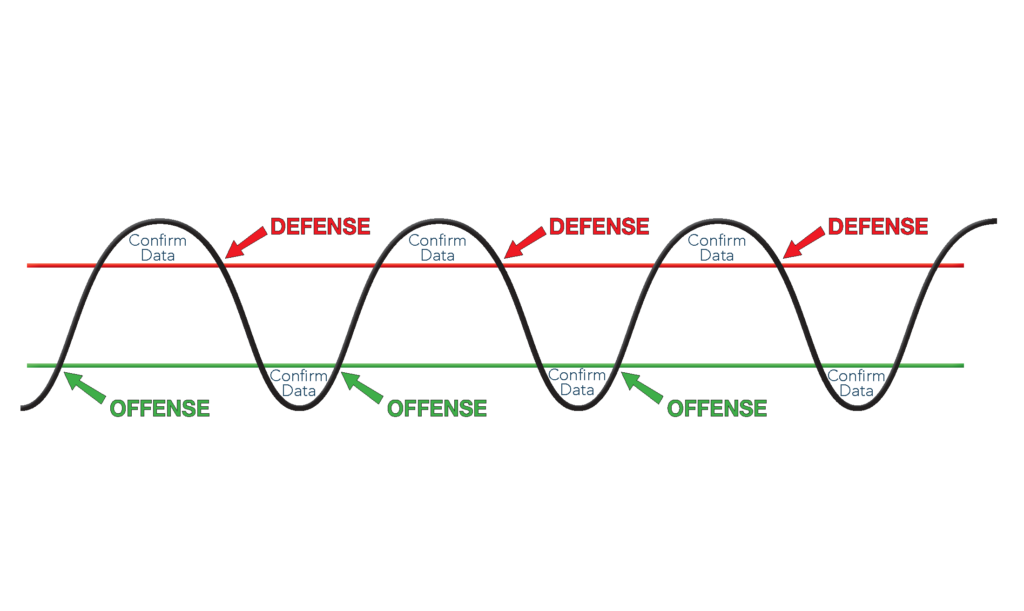

The Best Offense is a Stellar Defense

By combining proprietary algorithms and advanced portfolio construction,

GVCM delivers a highly-sophisticated form of diversification, with an

emphasis on downside protection.

For example: By limiting 50% of the downside and capturing 80% of the gains, you’ll experience 35% better performance.

Our strategic partnerships and advanced technologies have dropped the barriers for average investors.

The Power of Fintech

Our clients can have one portfolio custom-blended with multiple strategies. Through our extensive due diligence process, we’ve selected world class options to give our advisors and clients open architecture in their investment portfolio.

What are you doing to protect your assets?

GTAC offers five risk-based model portfolios that seek to protect investors from severe losses in down markets while attempting to outperform the broad global equity markets over a full market cycle. By employing long, short and neutral trend-following strategies across global asset classes, GTAC is unconstrained and seeks to improve portfolio diversification with historically low correlated investment strategies.

The science has evolved in portfolio construction for the retail investor based upon similar methodologies employed in Global Tactical Asset Allocation at the institutional level. Known widely by institutional investors who have been able to access across the equity, bond, commodity, currency and alternative asset class spectrum; advancements in technology, trading platforms and exchange-traded products have enabled the average investor to access asset classes and trading strategies that were difficult, if not impossible, until recently.

Have a question? Send us a message!

Understanding The Law of Losses Chart

Calculations by GVCM are for educational purposes to better understand the return necessary to recover losses and the amount of time required to breakeven.

Maximum Loss During High Risk Events Chart

Calculated by GVCM using data from AdvisorGuide, the research arm of GVCM. It is designed to demonstrate correlations in past declining markets during high risk events. The indices are unmanaged and not available for direct investment. These indices do not reflect any management fees, transaction costs, or expenses.

The Best Offense is a Stellar Defense Chart

Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark or index. Indexes are unmanaged and an investor cannot invest in an index directly. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable.

All calculations contained herein are based on third party material believed to be reliable, but are not guaranteed to be accurate or complete. Every effort has been made to ensure the accuracy of these calculations, however they cannot be guaranteed. GVCM does not guarantee the accuracy or completeness of this information, nor does GVCM assume any liability for any loss that may result from reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice and are for general information only and is not a complete analysis of every material fact. All investment strategies involve the risk of financial loss.